Ginnie Mae Early Buyout (EBO)

- – Sourcing of EBO assets and portfolios

- – Loan sale advisory (preparation of assets to put to market – Due Diligence, etc.)

- – Valuation and analysis of assets and forecasted performance

- – Servicing oversight and verification of servicing practices for EBO credit facilities

- – Loss analysis (review of claims and identification of loss event/party at fault)

EBO Servicers

Holders of GNMA servicing have important strategic decisions to make as delinquent loans become eligible for buyout from their respective securities.

Servicers have a range of options available to them when considering the best course of action for managing early buyout (“EBO”) eligible loans in their portfolio. There are many important considerations to take into account when evaluating GNMA EBO strategies such as cost of capital, advance obligations, special servicing capabilities, and market pricing for EBO trades.

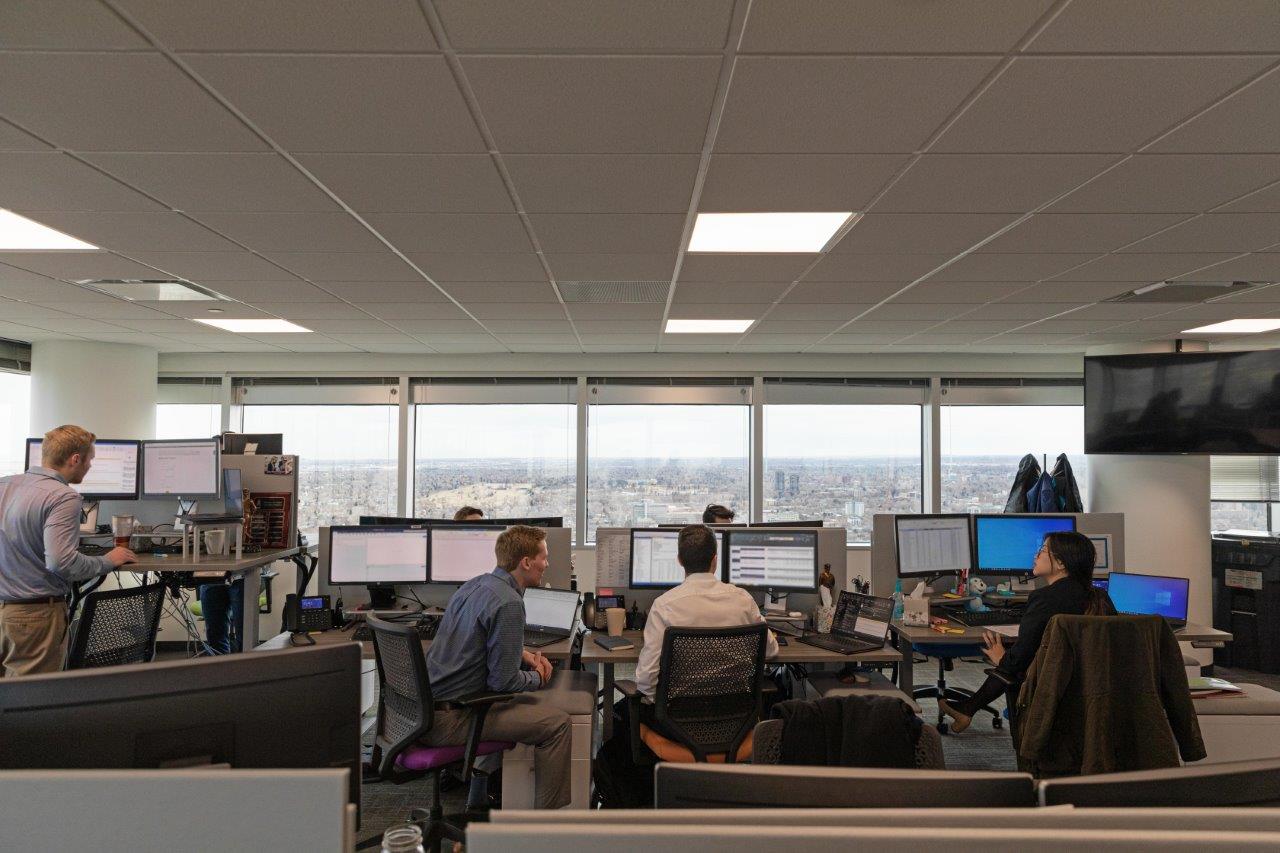

The PHOENIX Analytics Team is uniquely positioned to assist holders of GNMA servicing in this decision-making process. Our industry-leading cash flow modeling software, along with invaluable trade information and servicing insight from our Whole Loan Trading and Collateral Advisor desks, enable us to evaluate every aspect of GNMA EBO assets to help better inform your strategic decision-making process. Our approach focuses on modeling each pool at the loan level under a variety of scenarios, accounting for key loan characteristic drivers (FICO, LTV, pay history, etc.), and producing comprehensive cashflow outputs that are crucial for determining the most viable avenue for holders of GNMA EBO.

EBO Warehouse Lenders

Warehouse lenders that are involved in EBO financing, or that are considering entering the lending space for these assets, are presented with a unique array of risks and challenges that can arise from the complex nature of servicing delinquent GNMA mortgage loans.

Knowing and understanding the many scenarios that can arise when dealing with these assets provides a tremendous advantage in proper risk management for capital providers. In addition to understanding the various cashflow triggers that impact the ultimate value of an EBO pool, being able to quantify the sensitivity of the expected cashflows is a vital aspect in determining a proper advance rate and cost of funds.

PHOENIX has the capability to evaluate pools of GNMA EBO at the loan level, providing comprehensive cashflow reporting that can help properly inform warehouse lenders of the various risks associated with EBO financing. Our proprietary cash flow modeling software, combined with invaluable real-time trade & servicing information, enable us to uniquely identify the primary sources of risk for EBO assets. Combining these powerful analytic capabilities with our special servicing oversight and validation agent diligence services provides warehouse lenders with unique expertise to bolster superior governance and risk management.

Your Trusted Advisors

The PHOENIX Mortgage Services leadership team brings decades of hands-on servicing operations and quality control experience to each client partnership. With each engagement, our senior team is directly involved in developing solution architecture, recommendations and operational delivery.