Over the past month, there have been significant changes in the mortgage market, leaving future industry changes unclear. Loan portfolios are subject to a variety of risks, most notably interest rate risk and credit risk.

To help measure and manage these risks, PHOENIX provides our clients sensitivity analyses providing insights into how their loan portfolios would react to a variety of different changes in this volatile environment.

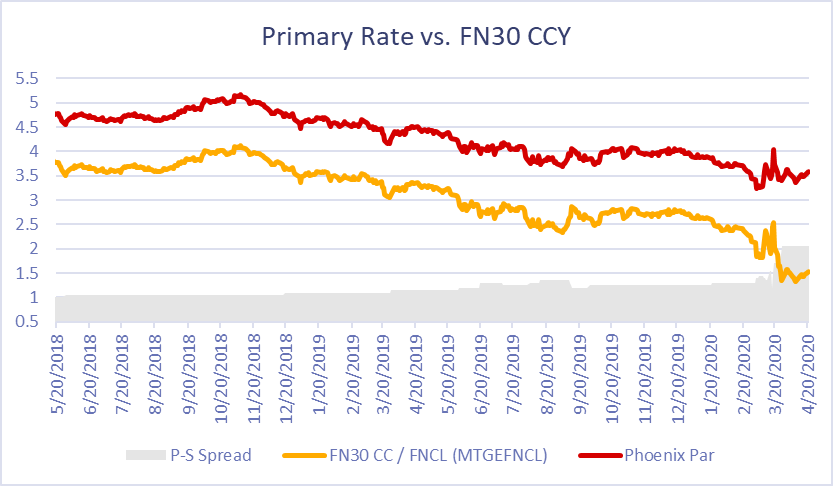

Interest rate risk is the exposure of an institution’s financial condition to adverse movements in interest rates. Interest rate risk includes both the level of interest rates in the economy, as well as the tightening and widening of spreads for specific asset types.

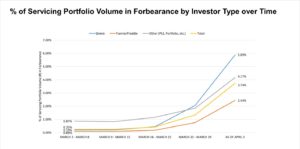

Credit risk includes both the risk of default as well as loss given default. Default risk has significantly increased along with massive rises in unemployment and sharp growth in delinquencies and Forbearance. We have seen unemployment claims climb to over 22 million, up from 212,000 in January of this year. With Forbearance at 0.25% at the beginning of March; it has since increased up to 3.74% at the beginning of April. The historic spike in unemployment claims over the last month, along with the looming recession, has created much uncertainty around the creditworthiness of consumer and mortgage debt.

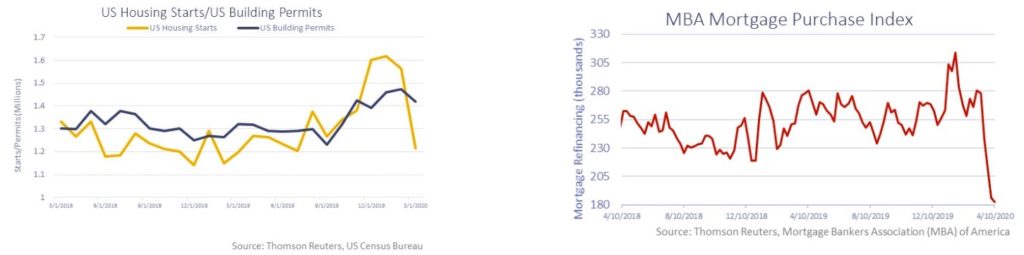

Loss given default is driven by the value of underlying collateral and the timeline for liquidation. The latter factor is expected to be lengthened considerably in the near term due to both forbearance and operational complexities related to foreclosure. Decreases in home prices in some areas are likely due to a drop in demand, increasing the likelihood of a loss in the event of default.

Turbulent market conditions lead to uncertainty for what the future has in store, however, this can be mitigated through proper risk management. In order to get a holistic perspective of the risks inherent in your portfolio, PHOENIX recommends a variety of scenario and sensitivity analyses. PHOENIX will quantify the change in portfolio value when key assumptions are stressed under a variety of different market conditions, including CPR, CDR, loss severity, risk free interest rate changes, and credit spreads. By utilizing our sensitivity analysis service, our clients will be able to properly identify risk in their portfolios and it will give their management team the information they need to make critical decisions according to their individual risk tolerance.

To find out more on how PHOENIX can help you mitigate through risk management, please contact a PHOENIX representative or Chris Ulrich at culrich@phoenixtma.com