Understanding Basel III Endgame and Its Impact

The finalization of Basel III, known as Basel III Endgame, brings significant changes to the risk weights applied to Mortgage Servicing Rights (MSRs) and Whole Loan. These changes could force bank servicers to reconsider their capital allocation strategies and the volume of servicing they can maintain. Both large banks with consolidated assets over $100 billion and smaller banks with significant trading activity must now hold a certain level of Tier 1 capital against risk-weighted assets (RWAs).

Key Capital Requirements

Minimum Capital Requirement:

4.5%

Well Capitalized:

8% of Tier 1 capital against RWA

Capital Requirement Formula:

Risk weight * asset value (MSR or whole loan). For every dollar that exceeds the threshold, an equal amount of capital must be held against it.

MSRs & Basel III CHANGES

Threshold Adjustments:

- Existing Rule: If (MSR – Deferred Tax Liabilities (DTL)) > 10% of Common Equity or (MSR – DTL – deductible items) > 15% of Common Equity, then the excess amount is deducted from Common Equity Tier 1 (CET1).

- Proposed Rule: If (MSR – DTL) > 25% of Common Equity, then the excess amount is deducted from CET1.

Risk Weight Adjustments:

- Existing Rule: MSRs below the threshold are risk-weighted at 100%.

- Proposed Rule: MSRs below the threshold are risk-weighted at 250%.

Whole Loans and Basel III Changes

Risk Weight Adjustments:

- Existing Rule: Whole loans are risk-weighted at 50%.

- Proposed Rule: Whole loans can be risk-weighted up to 90%. Add-ons for operational risk and stress tests can increase the risk weight to between 65% and 115%.

Warehouse Lines:

Credit Conversion Factor (CCF) for unused portion.

- Existing Rule for a 12-month commitment: 20% CCF

- Proposed Rule for a 12-month commitment: 40% CCF

POTENTIAL IMPACT

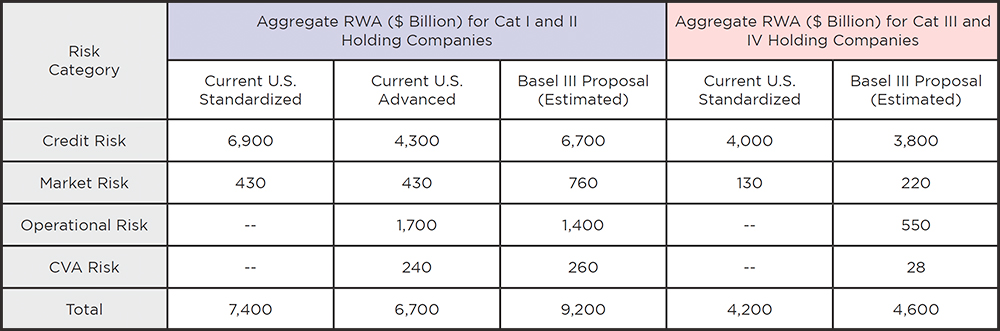

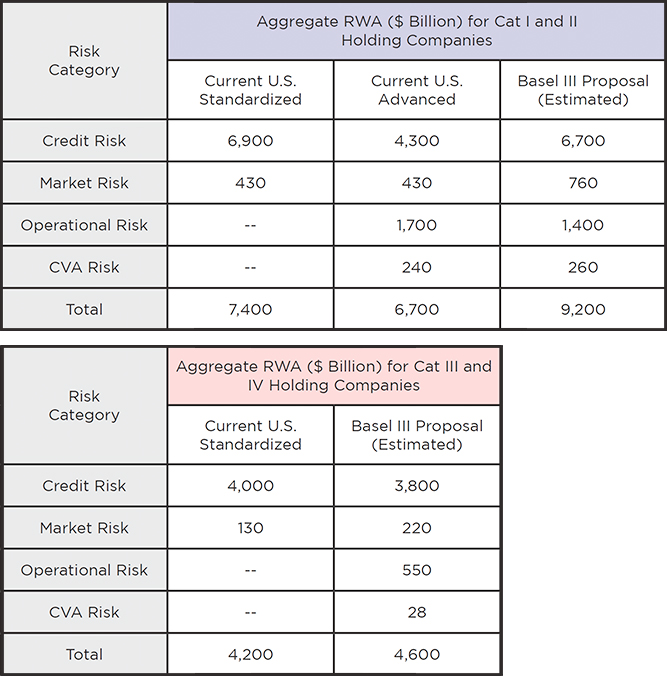

Below is an example from the Federal Register that illustrates the potential impact of the change in calculation or RWAs.

How PHOENIX Collateral Advisors (PCA) Can Help

MSR/Whole Loan Gap Analysis

Governance starts from the top. From appetite to capital planning, liquidity risk management, and loss mitigation, we help you identify gaps in your processes relative to leading practices.

Scenario Analysis

To mitigate the impact of adverse economic conditions on your Return on Equity (ROE), you need to know the potential impact of changes in key macroeconomic variables on your portfolio. From reductions in warehouse lines to capital relief, we do the modeling for you.

Optimal Portfolio Allocation

Given the diversity of the servicing market, servicers have unique business models and risk appetites requiring bespoke plans to help them achieve their target ROEs.

Tailored Offerings

Gap Analysis:

- Risk Identification / Risk Appetite

- Governance

- Scenario Design / Scenario Analysis

- Impact of delinquencies on warehouse lines

- FHA loss mitigation

MSR/Whole Loan Targeted Liquidity Risk Management Review

- Servicer Advance Scenario Analysis

- Systematic stress scenarios (economic recession, funding market disruption)

- Concurrent stress scenarios

- Idiosyncratic stress scenarios (reduced fundraising, ratings downgrade, negative news)

- Contingency Triggers

- Liquidity Limits: minimum liquidity buffer, remaining capacity, coverage ratios

- Early Warning Indicators: market indicators, firm-specific indicators

- Mitigating Actions

- Systematic: liquidity buffer, repo, restrict business activity

- Concurrent: liquidity buffer, repo, restrict business activity

- Idiosyncratic: liquidity buffer, review uncommitted pipeline, raise funds from committed

providers

Conclusion

Navigating the complexities introduced by the Basel III Endgame requires specialized knowledge and strategic planning. PHOENIX offers the expertise and tailored solutions to help you adapt to these regulatory changes efficiently.